Story Highlights

- There are significant generational differences in feelings about debt

- Four out of 10 Americans carry no debt -- not including mortgages

- Debt alone doesn't have a big impact on Americans' financial worries

What happens to Americans when they go into debt -- both psychologically and in terms of their behavior?

The in this two-part series looked at Americans' financial worries as they relate to debt. It also examined the actions indebted Americans take to cut costs and generate income. This article explores generational differences in attitudes toward debt and the overall implications of debt in America.

Generational Differences in Financial Worries

Gen Xers are significantly more worried than members of the other generations about not being able to pay medical costs in the event of a serious illness or accident and not having enough for retirement. None of the generations differ in how worried they are about their other financial commitments.

| Millen-nials% | Gen Xers% | Baby boomers% | Tradition-alists% | Overall% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Not being able to pay medical costs in the event of a serious illness or accident |

26 | 31 | 22 | 14 | 24 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not having enough for retirement | 20 | 32 | 23 | 15 | 23 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not having enough money to pay for their children's college |

25 | 21 | 11 | 5 | 17 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not being able to pay medical costs for normal healthcare |

18 | 18 | 14 | 12 | 16 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not having enough money to pay off their debt |

21 | 16 | 11 | 10 | 15 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not being able to maintain the standard of living they enjoy |

15 | 16 | 14 | 10 | 14 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not having enough money to pay their normal monthly bills |

13 | 12 | 11 | 11 | 12 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not being able to pay their rent, mortgage or other housing costs |

14 | 11 | 10 | 6 | 11 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not being able to make the minimum payments on their credit cards |

6 | 7 | 6 | 3 | 6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Â鶹´«Ã½AV | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Significantly higher percentages of younger Americans (millennials and Gen Xers) have engaged in cost-cutting or income-generating actions than older Americans (baby boomers and traditionalists). Millennials are significantly more likely than any of the other generations to put off marriage (18%), put off having kids (24%), put off furthering their education (34%) and to have moved in with parents or relatives (which one in five has done).

| Millen-nials% | Gen Xers% | Baby boomers% | Tradition-alists% | Overall% | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Put off some other major purchase, such as a vacation, home improvement project or major appliances |

48 | 51 | 36 | 23 | 42 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Put off buying a car | 39 | 35 | 21 | 14 | 28 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Put off furthering their education | 34 | 19 | 11 | 6 | 19 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sold some of their possessions to make ends meet |

20 | 23 | 15 | 10 | 18 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Took a job they would not have taken otherwise |

22 | 18 | 10 | 3 | 15 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not bought a house or apartment | 23 | 18 | 9 | 4 | 14 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Put off having children | 24 | 7 | 6 | 3 | 11 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Moved in with their parents or other relatives |

20 | 8 | 4 | 3 | 10 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Put off getting married | 18 | 6 | 5 | 2 | 9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Did not take a job they would have taken otherwise |

12 | 11 | 6 | 3 | 9 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Â鶹´«Ã½AV | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Saving Money Versus Spending Money -- and Debt

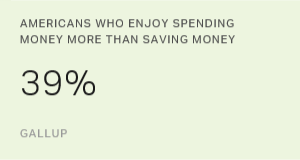

Four out of 10 Americans (39%) carry no debt (not including mortgages), and they have plenty of options and choices for how to spend their hard-earned wages. But the spending choices of those with debt are limited by the debts they incur. In many cases, those limitations stay with the consumer long after the thrill of the purchase has gone.

Surprisingly, Americans who enjoy spending money more than saving it -- and who have more debt -- are no more worried about their ability to cover their financial commitments than those who enjoy saving money more. Perhaps this is because the income of Americans who enjoy spending money more are higher on average than the income of those who enjoy saving money more. At the top of both groups' worry lists are "not having enough for retirement" and "not being able to pay medical costs in the event of a serious illness or accident." Both groups are least worried about "being able to make the minimum payments on their credit cards."

| Overall% | Enjoys spending more% | Enjoys saving more% | Difference (spending - saving)(pct. pts.) | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Not having enough for retirement | 23 | 25 | 22 | 3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not being able to pay medical costs in the event of a serious illness or accident |

24 | 22 | 25 | -3 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not having enough money to pay for their children's college |

17 | 18 | 16 | 2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not being able to pay medical costs for normal healthcare |

16 | 16 | 16 | ND | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not having enough money to pay off their debt |

15 | 15 | 14 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not being able to maintain the standard of living they enjoy |

14 | 14 | 14 | ND | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not having enough money to pay their normal monthly bills |

12 | 12 | 12 | ND | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not being able to pay their rent, mortgage or other housing costs |

11 | 10 | 11 | -1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not being able to make the minimum payments on their credit cards |

6 | 5 | 7 | -2 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Note: Sorted by % very worried overall. ND = no difference | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Â鶹´«Ã½AV | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Almost four in 10 Americans who enjoy spending money more than saving it (37%) have not engaged in any of the 10 cost-cutting or income-generating actions mentioned previously, such as putting off a major purchase, putting off buying a car or selling some of their possessions. Among those who enjoy saving money more than spending it, 46% have not engaged in any of these activities.

This pattern is reversed among those who have engaged in one or two of the actions to cut costs or generate income: 34% of those who enjoy spending money more have engaged in these behaviors, compared with 26% of those who enjoy saving money more. There are no differences among those who engaged in three or more debt-related actions for these groups.

With a few exceptions, Americans who say they enjoy spending money more than saving it engaged in 1.8 of the 10 cost-cutting or income-generating actions, compared with 1.7 actions for those who enjoy saving money more. At the top of the list for both groups are putting off a major purchase and putting off buying a car. Least common actions are putting off marriage, moving in with family members and forgoing a job they would otherwise have accepted.

| Enjoys spending more | Enjoys saving more | Have enough money to live comfortably | Do not have enough money to live comfortably | Overall | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| None | 37% | 46% | 54% | 23% | 43% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| One or two | 34% | 26% | 28% | 30% | 29% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Three to five | 21% | 20% | 15% | 32% | 21% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Six or more | 8% | 8% | 4% | 15% | 8% | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Average number of activities | 1.8 | 1.7 | 1.2 | 2.8 | 1.7 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Â鶹´«Ã½AV | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The only meaningful differences between spenders and savers are for putting off a major purchase (a difference of nine percentage points) and putting off furthering their education (a five-point difference), where spenders say they have engaged in those actions significantly more often than those who enjoy saving more.

Mortgaging the Future

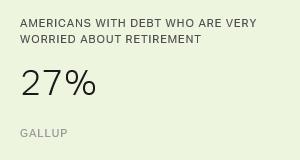

Six in 10 Americans (61%) carry at least some amount of debt while roughly one-third say they do not have enough money to live comfortably (35%). These data suggest that carrying debt does not, by itself, have much of an impact on Americans' financial worries other than giving them concern over retirement savings and their ability to cover injuries from an accident.

It is interesting to speculate that Americans have become inured to consumer debt and accepted it as an essential component of modern life. A previous article suggested that Americans who say they don't have enough money to live comfortably appear to be to supplement their available resources with high-interest credit. They carry 36% higher credit card balances than those who say they do have enough money to live comfortably.

Those who don't feel they have enough money to live comfortably may perceive consumer credit -- especially credit cards -- as a reasonable supplement to their means. Increased credit card use and other forms of borrowing could be a response to a consumerist society that believes "we deserve" these things, or it could stem from some other cause.

Whatever the reason, carrying debt is mortgaging the future -- if not practically then certainly psychologically. Not having enough money for retirement and not being able to pay the medical costs of a serious illness or accident are key sources of worry for all Americans, regardless of generation -- and regardless of whether they are spenders or savers, they do or don't carry debt, or do or don't have enough money to live comfortably. Putting off a major purchase or buying a car are the main actions people in all groups have taken to try to make ends meet.

Many Americans in these groups have had to make some hard choices to try to cut back. Putting off major purchases, putting off buying a car and selling some of their possessions to make ends meet can rapidly reduce a person's quality of life. Moreover, not buying things is bad for the economy.

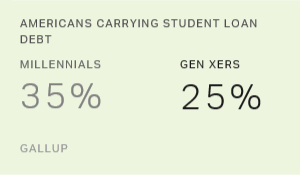

Because millennials are young and at the beginning of their careers and earning power, they are mortgaging more than the future by carrying debt: They are also mortgaging the present. Millennials are putting off getting married, having children, furthering their education and establishing their independence (by moving in with relatives) more than any other generation. This problem compounds if they have the added burden of student loan debt. Millennials' total consumer debt load is $29,000 -- but if that balance includes student loans, the total rises to over $40,000.

Consumer debt is a double-edged sword. On the one hand, it fuels the economy by giving consumers added purchasing power. On the other, it is a burden that limits individuals' choices in the future, such as buying a home or a car. And for those with student loans, it can become a crushing burden.

Survey Methods

Results of this Â鶹´«Ã½AV Panel survey are based on telephone interviews conducted Aug. 6-Sept. 10, 2015, with a random sample of 3,010 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia.

For results based on the total sample of national adults, the margin of sampling error is ±4 percentage points at the 95% confidence level.

Interviews are conducted with respondents on landline and cellular phones. All interviews were conducted in English. Each sample of national adults includes a minimum quota of 50% cellphone respondents and 50% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods. Landline respondents are chosen at random within each household on the basis of which member had the most recent birthday.

Samples are weighted to correct for unequal selection probability, nonresponse and double coverage of landline and cellphone users in the two sampling frames. They are also weighted to match the national demographics of gender, age, race, Hispanic ethnicity, education, region, population density and phone status (cellphone only/landline only/both and cellphone mostly). Demographic weighting targets are based on the most recent Current Population Survey figures for the aged 18 and older U.S. population. Phone status targets are based on the most recent National Health Interview Survey. Population density targets are based on the most recent U.S. census. All reported margins of sampling error include the computed design effects for weighting.

In addition to sampling error, question wording and practical difficulties in conducting surveys can introduce error or bias into the findings of public opinion polls.