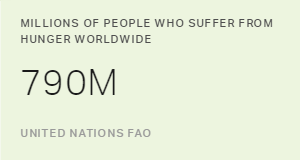

Financial inclusion, which the 2030 Agenda for Sustainable Development defines as "secure and equal access to financial services," can be a useful tool in fighting poverty and income inequality across countries. But what, if any, effect does it have on key aspects of human well-being, such as combating food insecurity?

The short answer, according to a working paper from a team of researchers at the Food and Agriculture Organization of the United Nations, is that it may depend on the type of financial service used.

Using cross-sectional data from the and the -- drawn from question modules that were included in the of more than 150 countries -- FAO researchers investigated the impact that formal financial products have on an individual's probability of experiencing food insecurity. This is the first time that this type of analysis has been attempted using both the FIES and Findex indicators from the U.N.'s Sustainable Development Goals.

Considering the problem of sample selection bias due to the non-experimental design of the data set, the researchers employed different matching methods -- entropy balancing, propensity score matching and fully interacting linear matching -- to estimate the impact of using different financial services on the probability of experiencing food insecurity.

The researchers analyzed the effects that different formal financial services (namely savings, credit and payments, used alone and in combination) have on the personal food security experiences in rural areas across 88 low- and middle-income countries. These countries typically have high concentrations of people who are underserved or excluded by the formal financial sector and living in poverty.

Among the three financial products, researchers found that only savings services -- whether used alone or in combination with credit and payment services -- reduce an individual's probability of experiencing food insecurity. When savings are absent, the use of payment services has no effect on insecurity and credit use significantly increases an individual's probability of experiencing food insecurity.

Such results imply that those individuals who decide to save at a formal financial institution to manage potential risks are able to accumulate and access extra money when needed, and thus are not likely to worry about the resources needed to obtain food.

Yet, using credit to undertake an important investment decision when one's own financial resources are insufficient requires strong repayment ability and can place a great burden on the household's income -- and is thus likely to reduce the household's consumption and negatively affect the personal experience of food security.

Payment services are commonly used for all sorts of optimal and non-optimal transactions, indifferently to income level, and thus are unlikely to directly influence the food security experience.

Implications

Our findings have interesting policy implications. Governments of developing countries -- in their reform agendas on financial inclusion -- usually focus on improving financial depth and outreach, which have both shown to bring clear results in terms of economic growth and poverty reduction. However, the impact of such reforms on other aspects of human well-being, especially food security, is not always as straightforward. Policymakers thus should carefully reconsider what are the most optimal financial inclusion reforms with respect to their different target priorities.

In this respect, our results suggest that more detailed information on personal well-being that goes beyond the usual monetary metrics needs to be considered as well. This will contribute to a better understanding of the behavioral constraints that limit the use of financial services, and it will help policymakers more effectively target their interventions that are aimed at changing the decisions of the poor.

These findings are from the FAO working paper, "The Impact of Financial Inclusion on Rural Food Security Experience: A Perspective From Low- and Middle-Income Countries."

Renata Baborska, researcher on financial inclusion at Food and Agriculture Organization of United Nations, Rome.

Emilio Hernandez, agricultural finance officer at Food and Agriculture Organization of United Nations, Rome.

Emiliano Magrini, economist at Food and Agriculture Organization of United Nations, Rome.

Cristian Morales-Opazo, economist at Food and Agriculture Organization of United Nations, Rome.