Donald Trump is a man who throws down gauntlets, and he threw down several big ones during his campaign for president -- confronting the status quos on immigration, on and on taxes, to name a few. He is now pursuing bold policy changes on each. But it could be Trump's action on taxes that matters most to whether the stock market continues to ride high, GDP growth returns to a healthy 3% and, therefore, whether his presidency is judged well in posterity.

News about taxes has been relatively slow thus far in Trump's administration. Judicial blowback against his immigration policies and Congressional blowback on healthcare reform have received far more attention than the general tax-plan principles he announced in April. Still, achieving detailed tax reform may prove even more difficult than his other policy struggles once the wheels start turning.

Before making tax reform a year-end goal, Treasury Secretary Steven Mnuchin initially said he hoped to complete tax reform by August. Senate Majority Leader Mitch McConnell reacted by saying that tax reform is a "very complicated subject" and harder to do now than the last time Congress achieved it in 1986. And passing the 1986 tax reform legislation was no easy task -- it required winning the support of a Democratic House and a Republican president, and took nearly two years of intense negotiations. Alluding more cynically to the significant political obstacles that often impede changing the tax code, former House Speaker John Boehner said the passing of a tax code overhaul is "just a bunch of happy talk."

Now, however, current Speaker Paul Ryan is also pushing for tax reform by the end of 2017, making these obstacles appear a little less daunting than if the administration were going it alone.

Aside from whether tax experts and Washington politicians are willing to upend the tax code, it is important to note where the American people stand on the need for action on taxes. It must be remembered that taxpayers may dislike the current tax system but not be convinced that Congress and the Trump administration will make it any better -- change could be worse. Without a strong push from the American people, Trump's tax reform might not materialize.

During the 2016 presidential campaign, Â鶹´«Ã½AV tested several of candidate Trump's tax proposals.

-

He advocated eliminating most federal income tax deductions and loopholes for the very rich, and Â鶹´«Ã½AV found 63% of American adults favoring this with just 17% opposed.

-

His proposal to simplify the federal tax code -- reducing the current seven tax brackets to four -- was also popular, with 47% agreeing and only 12% disagreeing.

-

Trump's plan to eliminate the estate tax paid when someone dies garnered considerably more agreement than disagreement from Americans, 54% to 19%. Notably, this is an issue that Congress and the wider public have considered in the recent past, and public sentiment on the issue today is in line with past Â鶹´«Ã½AV polls on this issue, such as when it asked about .

More recently, in March 2017, Americans viewed President Trump's general plan to "significantly cut federal income taxes for the middle class" positively: 61% agreed with the plan (with no mention of Trump in the question), 26% disagreed and 13% had no opinion. Trump's proposal to lower corporate tax rates, however, elicited a split decision, with 38% reacting positively, 43% negatively and the potentially decisive 19% "no opinion" group apparently needing more information.

These findings suggest Americans could respond favorably to many of the specific elements of Trump's ultimate tax plan, provided they make it into whatever legislation Congress winds up debating. For example, in spite of closing tax loopholes that favor the rich, the plan is expected to end up cutting taxes on the wealthy, not raising them. But as long as the plan also cuts taxes on the middle class, that fact alone is unlikely to sink it with Americans. Bush's across-the-board tax cuts in 2001, which more Americans at the time are a perfect illustration of this.

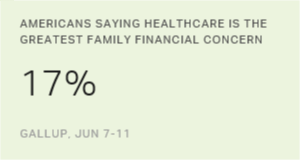

Whether Americans feel a sense of urgency about enacting tax reform is another matter.

In April 2017, Â鶹´«Ã½AV found that Americans' concern about their own federal tax burden had actually cooled somewhat, as barely half (51%) felt their taxes were "too high," down from 57% in 2016. By contrast, in June 1985, the year before the revolutionary Tax Reform Act of 1986 went into effect, 63% of Americans said their taxes were too high.

While public demand for lowering taxes may have waned, it is not gone. Public concern about taxes fell the most over the past year among Republicans -- a familiar political pattern given the partisan shift in presidential power. With a Republican in the White House, the Republican rank and file are less likely to say anything negative about the government, including about taxes. Still, 62% of Republicans call their taxes too high, as do 52% of independents and 39% of Democrats.

The implication? While not as intense as Congressional leaders may have expected, public demand for tax reform is still there, especially among the Republicans who may matter most to GOP lawmakers.

Common Ground Exists on Tax Reform

As the U.S. Congress is about to start its summer recess, tax reform remains ill defined by the administration, and negotiations over sub-issues like the border adjustment tax have stalled any pivot to immediate tax legislation. More importantly, there seems to be no bipartisan support this time, while there was under Reagan in 1986. Granted, this may seem like less of an issue now, as Republicans today control both the legislative and executive branches of the federal government. But real tax reform always makes for winners and losers, and it is problematic for only one party to pass new reforms. One need only look at the electoral consequences that Democrats have repeatedly suffered since 2010, the year they passed major healthcare reform legislation on party-line votes, to understand the danger Republicans could face if they pursue tax reform alone.

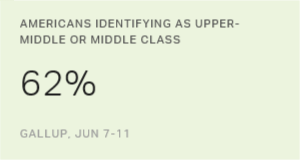

To make tax reform possible from a bipartisan standpoint, Congress needs to make sure the bill can be branded a "middle-class winner." As noted previously, Americans favor tax cuts for the middle class, and as the following table shows, Republicans and Democrats are also more likely to believe middle-income people are currently paying too much in taxes than to say they are paying their fair share or paying too little.

| Republican/Lean Republican | Democrat/Lean Democratic | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Too much | 51 | 49 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fair share | 40 | 43 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Too little | 5 | 7 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| No opinion | 4 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Â鶹´«Ã½AV, April 5-9, 2017 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

To ensure tax reform enjoys at least some bipartisan support, Democrats will need a win during negotiations, meaning taxes would likely need to be raised on the nation's wealthier class of citizens. Republicans are split on the issue of the fairness of taxes paid by upper-income people, but Democrats are in solid agreement that they pay too little.

| Republican/Lean Republican | Democrat/Lean Democratic | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Too much | 18 | 4 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Fair share | 38 | 13 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Too little | 40 | 82 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| No opinion | 4 | 1 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Â鶹´«Ã½AV, April 5-9, 2017 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Bottom Line

With the Trump administration wanting tax reform before the end of 2017, Ryan is now promising to put it on the front burner. However, even Republican leaders' enthusiasm for tax reform may not be enough to overcome the triad of legislative challenges that exist: the slimness of the Republican majorities in the U.S. House and Senate, the lack of bipartisanship in Washington and the power of special interest groups in Washington, D.C., to protect their vested interests. This is why comprehensive tax reform is historically so rare.

One thing working in Republicans' favor is that a majority of Americans support tax relief for the middle class, and members of both major parties tend to believe middle-class taxes are too high. If the bill can be positioned strongly as middle-class tax relief, its chances for success will be higher.