Who pays for Americans' health insurance? The answer to that question has changed significantly since 2001.

Sixteen years ago, more than six in 10 American adults (62%) interviewed as part of Â鶹´«Ã½AV's annual Health and Healthcare survey reported that their insurance was provided by a private source. About a quarter (26%) said their insurance was paid for by government-sponsored Medicare or Medicaid.

Now, in 2017, the share of Americans with privately paid insurance has decreased by 10 percentage points, to 52% of all adults. The percentage with insurance paid for by Medicare or Medicaid has increased by 11 points, to 37% today. The percentage of Americans who are uninsured, which rose from 11% to as high as 17% in 2013, has returned to where it was in 2001.

These shifts have occurred in two phases.

-

As the ranks of the uninsured rose after the Great Recession in 2008, the percentage of Americans with private insurance declined concomitantly. This most likely was a direct result of the massive and wrenching changes in the U.S. employment picture after the mortgage meltdown. During the resulting economic fallout, the unemployment rate peaked at 10% and -- with it -- the percentage of Americans with private health coverage dropped sharply between 2008 and 2011.

-

As the provisions of the 2010 Affordable Care Act (ACA) went into effect a few years after its passage, the percentage of Americans with insurance paid for by Medicare or Medicaid went up -- and the uninsured percentage began to fall again. One ACA provision was the optional expansion of Medicaid, something that 32 states and the District of Columbia so far have undertaken. As a result, the percentage of Americans with insurance paid for by the government increased as more low-income and disabled adults gained access to Medicaid coverage. The increase may also be partly attributable to gradual increases in the number of Americans eligible for Medicare as more and more baby boomers move past age 65 and retire.

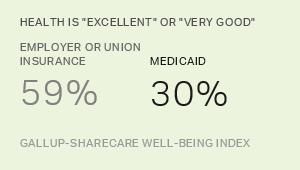

The other significant shift in the health insurance landscape since 2001 revolves around the relative monetary contribution of employers versus employees among those who have private insurance. As noted previously, the percentage of Americans with privately paid insurance has decreased since 2001. But within the private-pay segment of the population, the percentage who say their insurance is totally paid by an employer has decreased by 14 points. At the same time, the share who pay all of their own insurance has increased by eight points. (In the majority of cases, the costs of private insurance continue to be shared between employers and individuals.) Thus, even as the proportion of Americans with privately paid health insurance has declined, individuals who do have private insurance have seen their share of the cost burden increase relative to employers' share.

The increase in the proportion of Americans who fully pay for their private insurance is likely attributable in part to adults purchasing their coverage -- fully at their own expense -- through healthcare markets like the ACA exchanges, reflecting the individual mandate part of the ACA requiring all to have insurance.

This increase may also reflect the booming "gig" economy in which workers are hired for temporary work rather than as full-time company employees. Most of these workers -- now estimated to be about 60 million in the U.S. -- do not receive employee benefits like healthcare and thus must seek healthcare coverage on their own.

Congress' current efforts to pass new tax laws may result in lower government revenues and, thereafter, efforts to cut government spending. Additionally, if the new tax bill erodes the ACA mandate requiring all individuals to have insurance, we may expect to see the ranks of the uninsured to continue to rise, as it has in recent months.

At the same time, it is probably safe to assume that private industry will continue to look for ways to avoid paying health insurance costs. One way to do this is to increasingly hire employees who work on a contract basis. The rise in the "gig" economy provides tens of millions of Americans with employment, but the vast majority of gig employers do not offer health coverage. If the ACA mandate is weakened or eliminated, fewer contract employees may bother to get insurance, increasing the uninsured population.

Industry may also continue to push employees to bear an increasing percentage of the cost of employer-provided healthcare.

In summary, the future may well see trends toward a) lower employer involvement in healthcare, b) a shrinking Medicaid population, and, as a result, c) a higher national uninsured rate. Plus, given that young, healthy people are most likely of all age groups to choose to forgo insurance, healthcare premiums may rise for everyone else who attempts to buy insurance on their own.

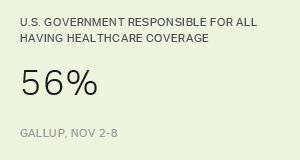

We know that half of U.S. adults now support the ACA and most Americans want to see changes in the landmark legislation. But relatively few want it repealed altogether, and new Â鶹´«Ã½AV research shows that 56% of Americans, in fact, want the government to be responsible for making sure all Americans have health insurance. Additionally, a group of Democratic senators has recently introduced legislation that would provide a single-payer, government-sponsored "Medicare for all" program. (The majority of Americans at this point say they don't know enough about this program to have an opinion on it.) All of this signals continuing tensions across party lines, and between the public and its representatives, as the nation attempts to reach some consensus on the best way to pay for healthcare.