Story Highlights

- More than six in 10 say corporations, upper-income Americans pay too little

- Views that middle-income earners pay too much have increased

- 14% say lower-income pay too little; down from high of 24% five years ago

WASHINGTON, D.C. -- As President Donald Trump and Republican leaders strategize about tax reform, the majority of U.S. adults believe that upper-income people and corporations are paying too little in taxes. In contrast, about half of Americans say middle- and lower-income people pay too much, while the other half says these groups are currently paying their fair share or are not paying enough.

| Fair share | Too much | Too little | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Middle-income people | 40 | 51 | 6 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Lower-income people | 35 | 48 | 14 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Upper-income people | 24 | 10 | 63 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Corporations | 19 | 9 | 67 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Sorted by "fair share" | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Â鶹´«Ã½AV, April 5-9, 2017 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

These results are based on Â鶹´«Ã½AV's 2017 Economy and Finance survey, conducted April 5-9.

The view that middle-income people pay too much in taxes has been higher each of the past two years -- at just over 50% -- than at any point since the George W. Bush tax cuts went into effect in the early 2000s.

Because few Americans say middle-income individuals pay too little in taxes, the major changes over the years have been shifts between the "too much" and "fair share" categories.

When Â鶹´«Ã½AV began asking this question in the 1990s, the "too much" viewpoint dominated. By 2003, after the first round of Bush tax cuts and the nation's increased focus on the war on terrorism, the percentage saying middle-income people paid too much fell significantly. At the same time, the perception that middle-income people's taxes were fair increased.

In 2014, the public once again showed more concern that middle-income taxpayers paid too much. Since then, Americans have continued to be more likely to say this group pays too much, rather than their fair share in taxes.

Half Say Lower-Income Pay Too Much

Americans' views of lower-income people's taxes are broadly similar to their views of taxes on those who are middle income. About half say both groups pay too much.

At the same time, Americans are more likely to believe lower-income people pay too little than say this about middle-income people. The belief that lower-income people pay too little in taxes rose from 10% in 2005, during the Bush administration, to as high as 24% during the Barack Obama administration in 2012 -- before dropping to 14% this year.

These shifts mainly reflect Republicans' shifting views. In 2005, 15% of Republicans said lower-income people pay too little in taxes. This rose to 40% by 2012, but fell back to 24% this year. Few Democrats have held the belief that lower-income people pay too little in taxes in any of these years.

More Than Six in 10 Say Upper-Income and Corporations Pay Too Little in Taxes

Slightly more than six in 10 Americans in recent years have consistently said that upper-income people pay too little in taxes. The view was even more widely held at points in the past, including in the early 1990s when three-quarters expressed this. This suggests that Trump faces a challenge in positioning or justifying tax reform efforts if they effectively end up lowering taxes for upper-income Americans.

Trump has also talked about lowering the tax rate on corporations. But two-thirds of Americans today say corporations pay too little in taxes, with less than one in 10 saying corporations pay too much. The public's attitudes about corporations' tax burden have been stable in recent years.

Implications

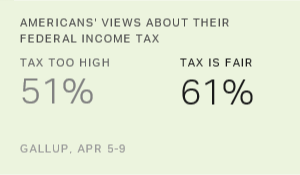

These findings provide insight into Americans' basic beliefs about the tax system at a time when tax reform is a major item on the legislative agenda. Other questions included in Â鶹´«Ã½AV's April survey that only about a third of Americans say their own personal tax burden is unfair, and roughly half say their taxes are too high.

This ends up as a quintessential "half empty or half full" situation. Clearly some Americans are dissatisfied with the tax system, both in terms of their perception of what others pay, and in terms of their assessments of their own tax situation. But no more than half of Americans are dissatisfied, leading to the conclusion that the need for relief from burdensome tax rates is, by no means, a universally held attitude.

Also, it is not clear how these basic beliefs about taxes may affect the public's acceptance of specific components of any tax plan that Trump will put forth in the future. For example, it appears that some of those who hold the view that middle-income people are paying their fair share could still support tax cuts for that group. Separate shows that 61% of Americans agree with a proposal to significantly cut federal income taxes for the middle class.

A significant majority of Americans believe that upper-income people and corporations pay too little in taxes, supporting showing that well less than half of Americans -- 38% -- agree with a proposal to cut corporate income taxes, and that the heavier taxes on the rich.

These data are available in .

Survey Methods

Results for this Â鶹´«Ã½AV poll are based on telephone interviews conducted April 5-9, 2017, with a random sample of 1,019 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia. For results based on the total sample of national adults, the margin of sampling error is ±4 percentage points at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 70% cellphone respondents and 30% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

View survey methodology, complete question responses and trends.