Story Highlights

- Majority of investors seek out, follow good advice; 10% are "pros"

- One in three rarely look at their portfolio, admit they "wing it"

- Less than half know two important facts about stock market performance

WASHINGTON, D.C. -- Diversification is often key when it comes to successful investing, but a recent Wells Fargo/Â鶹´«Ã½AV Investor and Retirement Optimism Index poll finds that investors themselves are diverse in their approach. Given four ways to describe their investing style, the majority of U.S. investors (55%) consider themselves "listeners" who know where to find good advice and usually follow it. Another 10% are self-proclaimed "pros" who do their own research and are confident in their abilities. Investors who take a more informal approach either describe themselves as "snoozers" who rarely look at their portfolio (24%) or as "instinctive investors" who say they mostly wing it (8%).

| U.S. investors | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A listener who knows where to get good advice, and usually follows it | 55 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A snoozer who hardly ever looks at your portfolio | 24 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A pro who does your own research and is confident in your abilities | 10 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| An instinctive investor who mostly wings it | 8 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| None/No opinion | 3 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wells Fargo/Â鶹´«Ã½AV, July 28-Aug. 6, 2017 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The large "listeners" group includes majorities of men, women, retirees, nonretirees, and those with high and medium asset levels. However, listeners are a bit more prevalent among female than male investors (60% vs. 51%, respectively). "Snoozers" are more common among nonretired investors and those with less than $100,000 in investments, compared with their counterparts. "Pros" are more common among retired investors as well as those with $100,000 or more invested.

| Pros | Listeners | Instinctive investors | Snoozers | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | % | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Gender | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Men | 12 | 51 | 9 | 25 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Women | 8 | 60 | 6 | 23 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Assets | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Less than $100,000 invested | 4 | 52 | 8 | 33 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| $100,000 or more invested | 14 | 58 | 7 | 19 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Employment | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Retired | 15 | 57 | 5 | 18 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Not retired | 8 | 54 | 9 | 26 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Full wording for investing styles: Pros = A pro who does your own research and is confident in your abilities; Listeners = A listener who knows where to get good advice, and usually follows it; Instinctive investors = An instinctive investor who mostly wings it; Snoozers = A snoozer who hardly ever looks at your portfolio. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wells Fargo/Â鶹´«Ã½AV, July 28-Aug. 6, 2017 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

These findings are from the third-quarter Wells Fargo/Â鶹´«Ã½AV Investor and Retirement Optimism Index survey, conducted July 28-Aug. 6. The survey reflects the views of U.S. investors with $10,000 or more invested in stocks, bonds or mutual funds.

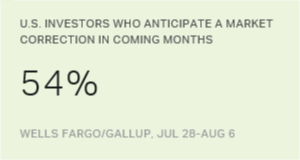

Other questions in the poll assess investors' knowledge by both asking individuals to grade their knowledge of stock investing and asking them two factual questions about the stock market's performance. Both approaches reveal that a majority of investors may be ill-equipped to manage their investments entirely on their own.

- When asked to grade their overall knowledge of stock investing, 23% give themselves a D or F, and another 37% give themselves a C. About four in 10 think they deserve an A (8%) or B (31%).

- When asked whether investments that are riskier tend to provide higher or lower returns over time than investments with less risk, 70% correctly answer that higher-risk investments tend to provide higher returns. Twenty-one percent say they provide lower returns.

- When asked to identify the best-performing type of investment over the past 20 years from four basic instruments widely available to consumers, 64% correctly identify stocks, while more than a third say gold (16%), bonds (8%) or CDs (6%).

Altogether, slightly less than half of investors, 46%, answer both questions about market performance correctly. Another 40% answer just one of the two correctly, while 13% do not answer either correctly.

Â鶹´«Ã½AV Analytics

Subscribe to our online platform and access nearly a century of primary data.

Higher-Asset Investors Generally More Knowledgeable

The largest differences on these knowledge questions are seen by investor class. Those with $100,000 or more invested are more likely to grade their knowledge of stock investing an A or B, as well as more likely to answer the knowledge questions correctly. The knowledge gap is especially wide in terms of higher-asset investors' awareness that stocks have outperformed bonds, CDs and gold over the long term.

| $100,000 or more | Less than $100,000 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How they grade their own investing knowledge: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A/B | 48 | 25 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| C | 34 | 45 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| D/F | 19 | 29 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Know that riskier stocks tend to produce higher returns | 73 | 67 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Know that stocks have produced highest returns in past 20 years | 71 | 53 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wells Fargo/Â鶹´«Ã½AV, July 28-Aug. 6, 2017 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Naturally, there are strong relationships between how investors describe their investing style and how they assess their knowledge of the market or answer factual questions about it.

Among self-described investing "pros," 29% grade themselves an A and 45% a B -- grades largely consistent with their professed expertise. However, 21% give themselves a C and 3% a D or F, casting doubt on their prowess. More than 70% of pros do answer each of the knowledge questions correctly.

In line with their lackadaisical approach, most "snoozers" (82%) grade their knowledge of investing a C or worse, although 16% give themselves an A or B. "Listeners" are more variable, with large segments falling into the high, medium and low grades. Both groups are less likely than pros to answer the knowledge questions correctly.

There are not enough "instinctive investors" to report their self-reported knowledge of stock investing.

| Pros | Listeners | Snoozers | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How they grade their own investing knowledge: | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| A/B | 74 | 42 | 16 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| C | 21 | 39 | 42 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| D/F | 3 | 17 | 40 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Know that riskier stocks tend to produce higher returns | 80 | 69 | 74 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Know that stocks have produced highest returns in past 20 years | 71 | 66 | 59 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Full wording for investing styles: Pros = A pro who does your own research and is confident in your abilities; Listeners = A listener who knows where to get good advice, and usually follows it; Snoozers = A snoozer who hardly ever looks at your portfolio. Instinctive investors not shown due to low sample size. | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wells Fargo/Â鶹´«Ã½AV, July 28-Aug. 6, 2017 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Bottom Line

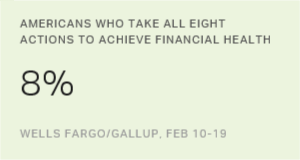

Roughly four in 10 Americans have $10,000 or more in investments, qualifying them as "investors" in the Wells Fargo/Â鶹´«Ã½AV investor survey. This broad swath of investors includes some who appear quite savvy and capable of monitoring and managing their own investments. In particular, 10% consider themselves investing pros and 39% grade themselves an A or B for their knowledge of stock investing. However, the majority admit some deficiency in knowledge or habits regarding investing that could leave them exposed to mistakes or at least lost opportunity in the market.

Fortunately, the majority of investors report that they seek out and listen to good advice -- so even if they lack the knowledge or time needed to stay on top of their investments, they can tap into advice.

The next report from this poll will look at investors' use of professional financial advisers and how it relates to their own knowledge and style of investing.

Survey Methods

Results for the Wells Fargo/Â鶹´«Ã½AV Investor and Retirement Optimism Index survey are based on questions asked July 28-Aug. 6, 2017, on the Â鶹´«Ã½AV Daily tracking survey, of a random sample of 1,006 U.S. adults having investable assets of $10,000 or more.

For results based on the total sample of investors, the margin of sampling error is ±4 percentage points at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 70% cellphone respondents and 30% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

Learn more about how the works.