Story Highlights

- 20% of nonretired investors have calculated retirement expenses, revenue

- Pre-retirees most likely to have considered retirement activities and location

- They are least likely to have thought about retirement taxes

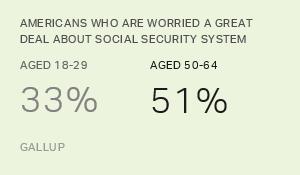

WASHINGTON, D.C. -- Most nonretired U.S. investors have not carefully calculated how much money they will need in retirement or whether their retirement accounts will cover their annual expenses. While one in five say they have done each of these calculations, two in five admit that they have not given much thought to either, and one-third say they have roughly estimated their retirement expenses and revenue.

| Have done calculations | Have estimated it | Have not thought much about it | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The amount of income you will need each year in retirement | 20 | 32 | 41 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The amount of income your retirement accounts will generate for you in retirement | 20 | 33 | 40 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wells Fargo/Â鶹´«Ã½AV, Feb. 12-25, 2018 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The latest results are based on the first-quarter Wells Fargo/Â鶹´«Ã½AV Investor and Retirement Optimism Index survey, conducted Feb. 12-25, 2018. For this survey, U.S. investors are defined as adults with $10,000 or more invested in stocks, bonds or mutual funds, either within or outside of a retirement savings account.

Nonretired investors approaching retirement age are slightly more likely than younger pre-retirees to report having spent time calculating how much money they will need in retirement or what their retirement income and expenses will be.

Those who have less than $100,000 invested (generally younger people) are less likely than those with $100,000 or more invested (typically older people) to have performed specific retirement calculations.

Nonretired Most Likely to Have Considered Retirement Leisure Activities

The poll also asked nonretired investors how much thought they have given to seven different aspects of retirement. Other than how they will spend their time when retired, fewer than half of nonretired investors have given at least a fair amount of thought to the other aspects of retirement planning.

| A lot | A fair amount | A little | None | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | % | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How you will spend your leisure time | 34 | 19 | 28 | 11 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Where you will live | 32 | 16 | 29 | 16 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How you will pay for routine medical care | 27 | 18 | 30 | 17 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

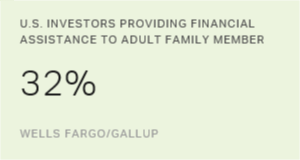

| The best age for you to start taking your Social Security benefit | 26 | 19 | 28 | 17 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The strategy you will use to draw income from your retirement savings accounts | 21 | 20 | 30 | 21 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| How you will pay for possible long-term care or assisted living | 20 | 17 | 32 | 23 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| The amount of taxes you will pay in retirement | 16 | 18 | 33 | 25 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wells Fargo/Â鶹´«Ã½AV, Feb. 12-25, 2018 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Overall, the percentages of nonretired investors who say they have thought "a lot" or "a fair amount" about each aspect of retirement are:

- how they will spend their leisure time as retirees -- 53%

- where they will live -- 48%

- how they will pay for routine medical expenses -- 45%

- when to start receiving Social Security -- 45%

- a strategy to draw income from their retirement accounts -- 41%

- how to pay for long-term care or assisted living -- 37%

- the amount of taxes they will pay in retirement -- 34%

As would be expected, the amount of thought nonretired investors have given to various aspects of retirement increases the closer they are to retirement age. Half or more of nonretired investors aged 60 and older say they have given at least a fair amount of thought to each of the seven aspects, but far fewer of those younger than 40 have given them as much thought.

Retired Investors' Assessments of Their Own Situations

Retired investors were asked to think back and report on how much thought they had given to the seven facets of retirement in the years before they retired, and their responses were generally similar to those of the nonretirees aged 60 and older. More than seven in 10 retired investors said they were prepared for these seven retirement decisions, but 19% wish they had thought them through earlier and 9% were unsure.

| Yes, was prepared | Wish had given more thought earlier | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 72 | 19 | ||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wells Fargo/Â鶹´«Ã½AV, Feb. 12-25, 2018 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

The median age at which retired investors say they retired is 62. At a time when many older Americans are working longer to make up for a lack of savings and maximize their Social Security benefits, nearly one-quarter of retired investors say they exited the workforce earlier than they would have liked. Still, two-thirds say they retired at their desired age.

| Earlier than would have liked | Later than would have liked | At time wanted to | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| % | % | % | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| 22 | 3 | 67 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| Wells Fargo/Â鶹´«Ã½AV, Feb. 12-25, 2018 | |||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Bottom Line

Most nonretired U.S. investors -- particularly those who are younger -- have not calculated their anticipated retirement income or expenses with any specificity. They are also in no rush to plan ahead for some of retirement's thornier issues, including how they will pay for routine medical expenses, when to start receiving Social Security, and what they will do about long-term care or assisted living. They are most likely to have thought about how they will spend their leisure time and where they will live in their golden years.

While working later in life in order to maintain income and maximize Social Security may sound appealing to those who have not yet retired, health crises, layoffs and other issues beyond investors' control could derail these plans. As such, investors would be well-advised to start their retirement planning as early as possible.

Survey Methods

Results for the Wells Fargo/Â鶹´«Ã½AV Investor and Retirement Optimism Index survey are based on telephone interviews conducted Feb. 12-25, 2018, on the Â鶹´«Ã½AV U.S. Daily survey, with a random sample of 1,321 adults, aged 18 and older, living in all 50 U.S. states and the District of Columbia having investments of $10,000 or more.

For results based on the 842 nonretired investors, the margin of sampling error is ±4 percentage points at the 95% confidence level. For results based on the 477 retired investors, the margin of sampling error is ±6 percentage points at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 70% cellphone respondents and 30% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

Learn more about how the works.