Over the past couple of years, congressional legislation and a re-energized Securities and Exchange Commission (SEC) have had some success in restoring investor confidence in the integrity of corporate America. But the cost of addressing corporate abuse has been high, as Sarbanes-Oxley and new regulatory burdens have been placed on U.S. companies, the majority of which are well run with honest managements.

Still, the clean up seems far from complete as significant accounting abuses continue to surface at such major companies as AIG, Fannie Mae, and Freddie Mac. Thus, it should not be surprising that 46% of investors say "questionable accounting practices in business" are hurting the investment climate "a lot," according to the most recent UBS/Â鶹´«Ã½AV Index of Investor Optimism survey*. This concern over accounting practices also may explain, at least in part, why 55% of Americans say it is a "bad idea" to invest a $1,000 in the stock market these days, according to the June Experian/Â鶹´«Ã½AV Personal Credit Index poll**.

Last week's resignation by SEC Chairman William Donaldson, and the nomination of California Rep. Christopher Cox to replace him, was a major surprise -- particularly given the continued lack of confidence on the part of many Americans in the basic fairness of the U.S. equity markets. Is this change of leadership at the SEC a sign that the Bush administration believes investor confidence has been adequately restored at this point, and that it's time to rationalize the onerous regulations created during recent years?

Hurting "a Lot"

Three years ago, a series of spectacular corporate failures, including Enron and WorldCom, combined to undermine many investors' confidence in American business. In May 2002, 60% of investors said the issue of questionable accounting practices was hurting the investment climate a lot, and that percentage rose to 80% in July 2002. By November 2003, the percentage of investors pointing to accounting abuses as a major issue overhanging the markets had declined to 49%. Consistently since that point, however, more than 4 in 10 investors have continually pointed to questionable accounting practices as hurting the investment climate a lot.

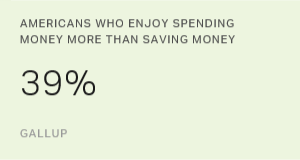

Preference for Savings Accounts

As part of the June Experian/Â鶹´«Ã½AV Personal Credit Index survey, Â鶹´«Ã½AV asked consumers which they think is the better investment these days: putting $1,000 in the stock market or putting $1,000 in a savings account. Despite today's low rates of return on savings accounts, 58% of consumers tell Â鶹´«Ã½AV they would rather put money in a savings account than the stock market.

The SEC chairmanship is second only to that of the Federal Reserve Board in terms of its importance to the business community and investors. While the Cox nomination is generally perceived as friendly to business, it is also a shift away from investor advocacy. For example, columnist Steven Pearlstein wrote in the Washington Post on Friday, "Cox has repeatedly demonstrated a preference for sacrificing investor protection to the larger cause of promoting economic growth. He is more ideologue than pragmatist, and an unabashed partisan to boot. Those hardly seem like the necessary qualifications to succeed Bill Donaldson, a champion of the investor, a paragon of independence and a general all-around pro."

What Cox might do as SEC chairman is a matter of conjecture and Pearlstein's comments themselves might be seen as "unabashedly partisan." However, current investor/consumer opinion data show he is right about the need for an investor advocate at the SEC. Rebuilding confidence in the integrity of corporate America and the fairness of the equity markets still has a long way to go. If the new SEC chairman is perceived as a strong advocate for business at the expense of the average investor, then the renewed confidence that has been achieved over the past several years could dissipate quickly.

*Results for the Index of Investor optimism are based on telephone interviews with 802 investors, aged 18 and older, conducted May 1-15, 2005. For results based on the total sample of national adults, one can say with 95% confidence that the maximum margin of sampling error is ±4 percentage points.

**Results for the Personal Credit Index are based on telephone interviews with 1,010 adults, aged 18 and older, conducted May 13-19, 2005. For results based on the total sample of national adults, one can say with 95% confidence that the maximum margin of sampling error is ±3 percentage points.