Story Highlights

- 62% of U.S. investors are concerned by stock market volatility

- In February, 53% of investors were concerned

- Little change in confidence, optimism about stock market

WASHINGTON, D.C. -- More than six in 10 U.S. investors (62%) now say they are concerned about the stock market's volatility, according to a new Wells Fargo/Â鶹´«Ã½AV Investor and Retirement Optimism Index survey. In February, before the huge stock market fluctuations in late summer and fall, a bare majority of 53% expressed concern.

Eighteen percent of U.S. investors now say they are "very" concerned about market volatility, up slightly from 14% in February; another 44% are "somewhat concerned," an increase from 39%. At the same time, the rising concern has not adversely affected investors' long-term confidence in stocks as a place to save and invest for retirement -- 43% now say they have "a great deal" or "quite a lot" of confidence, compared with 40% in February.

Two other key measures of investors' views also changed little:

- Forty-four percent of investors in February said they were optimistic about the stock market's performance "over the next 12 months"; 45% are optimistic now.

- Looking at the larger picture of all financial markets, including stocks, 58% of investors said in February that "now is a good time to invest"; 54% feel that way now.

While overall views about whether it is a good time to invest in financial markets did not change significantly, investors who are very concerned about the market's recent ups and downs are much more likely to think it is a bad time to invest in financial markets (75%) than those who are somewhat concerned (39%) or are not too or not at all concerned (31%).

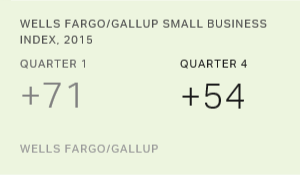

The most recent findings are from the fourth quarter Wells Fargo/Â鶹´«Ã½AV Investor and Retirement Optimism survey of U.S. investors conducted Oct. 30-Nov. 8. For this survey, investors are defined as U.S. adults who have at least $10,000 invested in stocks, bonds or mutual funds, either in an investment account or a retirement fund -- a definition that approximately 40% of U.S. adults fit.

Investors Brace for More Market Volatility at Start of New Year

Nearly three in four (74%) investors expect the market to be "somewhat" (58%) or "highly" (16%) volatile at the start of 2016. Americans with more than $100,000 invested are more likely to predict volatility (79%) than are those with smaller investments (68%).

Those expecting volatility at the start of 2016 are more likely to say they will buy stocks in hopes of taking advantage of low prices (30%) than to say they will sell stocks to protect from further losses (15%).

That would fit the pattern among stock owners in August, when the most extreme recent market fluctuations occurred. In that month, the Dow Jones Industrial Average plummeted more than 1,100 points -- the Dow's biggest percentage drop in more than five years. One in four stock owners (25%) in the most recent poll say they reacted to the August volatility by buying stocks, almost twice as many as say they sold off stocks (14%).

In addition to buying or selling stocks as a response to the August fluctuations, half of stock owners say they reviewed their portfolio online, half say they paid closer attention to the market than usual and a third consulted with a financial adviser. Investors who consulted a financial adviser during that time were more likely to sell and to buy than those who didn't seek advice.

Bottom Line

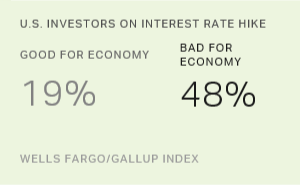

As investors look back at the recent huge swings in the stock market and forward to the rise in interest rates the Federal Open Market Committee approved on Wednesday, it's not surprising that their concerns about stock market volatility have risen. However, those concerns do not appear to have had a major effect on long-term confidence in stocks as a good investment, nor have they made investors more eager to sell than to buy stocks.

Survey Methods

Results for the Wells Fargo/Â鶹´«Ã½AV Investor and Retirement Optimism Index survey are based on questions asked Oct. 30-Nov. 8, 2015, on the Â鶹´«Ã½AV Daily tracking survey, of a random sample of 1,018 U.S. adults having investable assets of $10,000 or more.

For results based on the total sample of investors, the margin of sampling error is ±4 percentage points at the 95% confidence level. All reported margins of sampling error include computed design effects for weighting.

Each sample of national adults includes a minimum quota of 60% cellphone respondents and 40% landline respondents, with additional minimum quotas by time zone within region. Landline and cellular telephone numbers are selected using random-digit-dial methods.

Learn more about how the works.